IRS Allows Use of Pass-Through Business Alternative Taxes to Bypass 2017 Tax Act’s Limitation on SALT Deductions – Effectively Blessing New Jersey Statutory Work-Around

On Monday, November 9th, the IRS issued Notice 2020-75 stating that it intended to issue proposed regulations to clarify that state and local income taxes imposed on and paid by a partnership or an S corporation would be deductible by such entity regardless of whether the liability for such taxes is the result of an election by the entity or whether the partners or S shareholders receive a partial or full state or local deduction, exclusion, credit, or other tax benefit that is based on their share of the amount of such taxes paid by the entity. Taxpayers will not need to take such tax payments into account in applying the 2017 Tax Act’s $10,000 cap on state and local taxes.

Notice 2020-75, effective immediately, appears to directly support the efficacy of New Jersey’s work-around (S-3246/A-4807) adopted early in 2020 to address the federal 2017 Tax Act’s $10,000 cap on state and local taxes (SALT). Because that cap applies predominantly to real property taxes and sales taxes in addition to income taxes, business taxpayers who can use the work-around and remove business income taxes from the $10,000 cap will effectively be allowed to deduct an additional amount of other SALT taxes under the cap.

The New Jersey law, commonly called the Pass-Through Business Alternative Income Tax, is available to partnerships, limited liability companies (LLCs) treated as partnerships for federal income tax purposes, and S corporations (but not sole proprietors or single member LLCs). These permitted entities can elect to pay their New Jersey state income taxes on their taxable incomes directly at the entity level as a business tax rather than at the owner level under the Gross Income Tax (GIT) or Corporate Business Tax (CBT). In turn, the law allows the owners a corresponding refundable GIT or CBT credit, which in combination, means that such business income taxes are largely free of the $10,000 cap. The election is an annual election to be made at the entity level, with the consent of either (i) all of the owners, or (ii) an authorized officer, manager, or other tax representative of the pass-through entity.

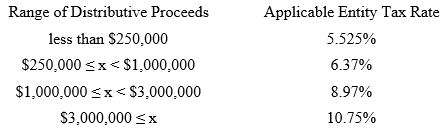

The entity’s New Jersey tax under the Pass-Through Business Alternative Income Tax is calculated based on each owner’s pro rata share of the entity’s “distributive proceeds” for the taxable year. The applicable tax rates are progressive and vary according to the pass-through entity’s total distributive proceeds (and is scheduled to increase slightly in future years):

For each pass-through entity in which the taxpayer has an ownership interest, the amount of the credit is equal to the owner’s pro rata share of the entity-level tax paid multiplied by 89.25%, which credit is applied against the GIT liability of the individual owner in the taxable year, or, for corporate owners, against the corporation’s CBT liability. By applying this 89.25% discount factor, effectively, the State is taking a cut of the effective federal income tax savings available to taxpayers through the Pass-Through Business Alternative Income Tax. Because the tax rates applied under the Pass-Through Business Alternative Income Tax don’t correspond directly with the comparable GIT rates at the same amounts of income, it is hard to easily measure a taxpayer’s net savings without running some calculations.

Although New Jersey’s election forms and estimated tax forms have not yet been issued, taxpayers will have until the initial un-extended due date of the entity’s state income tax return to make the election. Because 2020 is the first year for the Pass-Through Business Alternative Income Tax, no penalties will be imposed by New Jersey for failure to pay any otherwise late estimated tax payments, according to the Division of Taxation’s website.

The IRS issuance of Notice 2020-75 effectively blesses New Jersey’s approach to the 2017 Tax Act’s limitation on state and local taxes. Business owners operating in New Jersey through a pass-through structure owe it to themselves to take a closer look at this option, run some calculations, and then possibly make the required entity election by the unextended due date of the entity’s tax return if it makes sense for them.

We would be happy to talk with current and potential clients who have questions on the New Jersey pass-through election, or on federal or New Jersey taxation in general.